Spain offers tax incentives for international shoots of feature length films, television series, animated films, and documentaries. The incentives are in the form of a tax rebate of up to 30%, except for in the Canary Islands, where it is up to 54%.

Mainland and Balearic Island parameters

-Minimum overall budget 2 million €, minimum qualifying spend in Spain (used & consumed) = 1M€

-General deduction: 30% on first million €, 25% thereafter.

-For series, as from 2023, same ratio (30/25) as above, per episode

-Maximum return capped at 20 million € and for series 10 million € per episode

-Minimum qualifying spend in Spain for animation and VFX projects is € 200K.

Canary Island parameters:

-Minimum overall budget 2 million €, minimum qualifying spend in Spain (used & consumed*) = 1M€

-54% deduction on first million €, 45% deduction thereafter

-For series, as from 2023, same ratio (54/45) as above, per episode

-Max return capped at 36 million €uro per project, and for series 18 million € per episode

-Exclusively in the CI, a tax-exempt certificate can be obtained, hence the cash flowing of IGIC (CI VAT) is almost insignificant

For both instances:

-Qualifying cost (deduction base) may not exceed 80% of total budget

-Total rebate claim may not exceed 50% of production cost.

Requisites:

-Cultural Test compliance.

-Indicate in credits that the production has benefited from the Spanish tax incentive (LIS. 36.2), and acknowledge collaboration of Govt of Spain, specific ministries if applicable, or relevant support from bodies such as local authorities, Film Commissions and Offices, Police Dept, etc.

-Authorize the use of the title of the work and graphic and audiovisual press material that expressly includes specific locations of filming or any other production process carried out in Spain, for carrying out activities and preparing promotional materials in Spain and abroad for cultural or tourist purposes, which can be carried out by state, regional, or local entities with competences in matters of culture, tourism, and economy, as well as by the Film Commissions or Film Offices that have intervened in filming or production.

Notes:

ATL & BTL – Creative personnel (Director, Cast, writers, DOP, Prod designer, Editor, Composer, Costume Des, Sound mixer, Makeup & Hair designer) qualify only if EU tax residents. However, all foreign technicians and equipment (used & consumed in Spain) do.

The rebate is accessed via a Spanish company Corporate Tax return, for which we create a designated SPV (Special Purpose Vehicle) for each project, this SPV is administered by us and is required to stay operative for some 3 to 4 years.

Only costs incurred after the date of constitution of the SPV will be eligible for the rebate.

Depending on the SPVs fiscal calendar, corporate tax return is submitted 7 months from the end of the fiscal year, and from that time the average refund period is 6 to 7 months.

Cast is subject to withholding tax – 19% if EU, 24% others. This is a direct obligation if not engaged by the Spanish company,

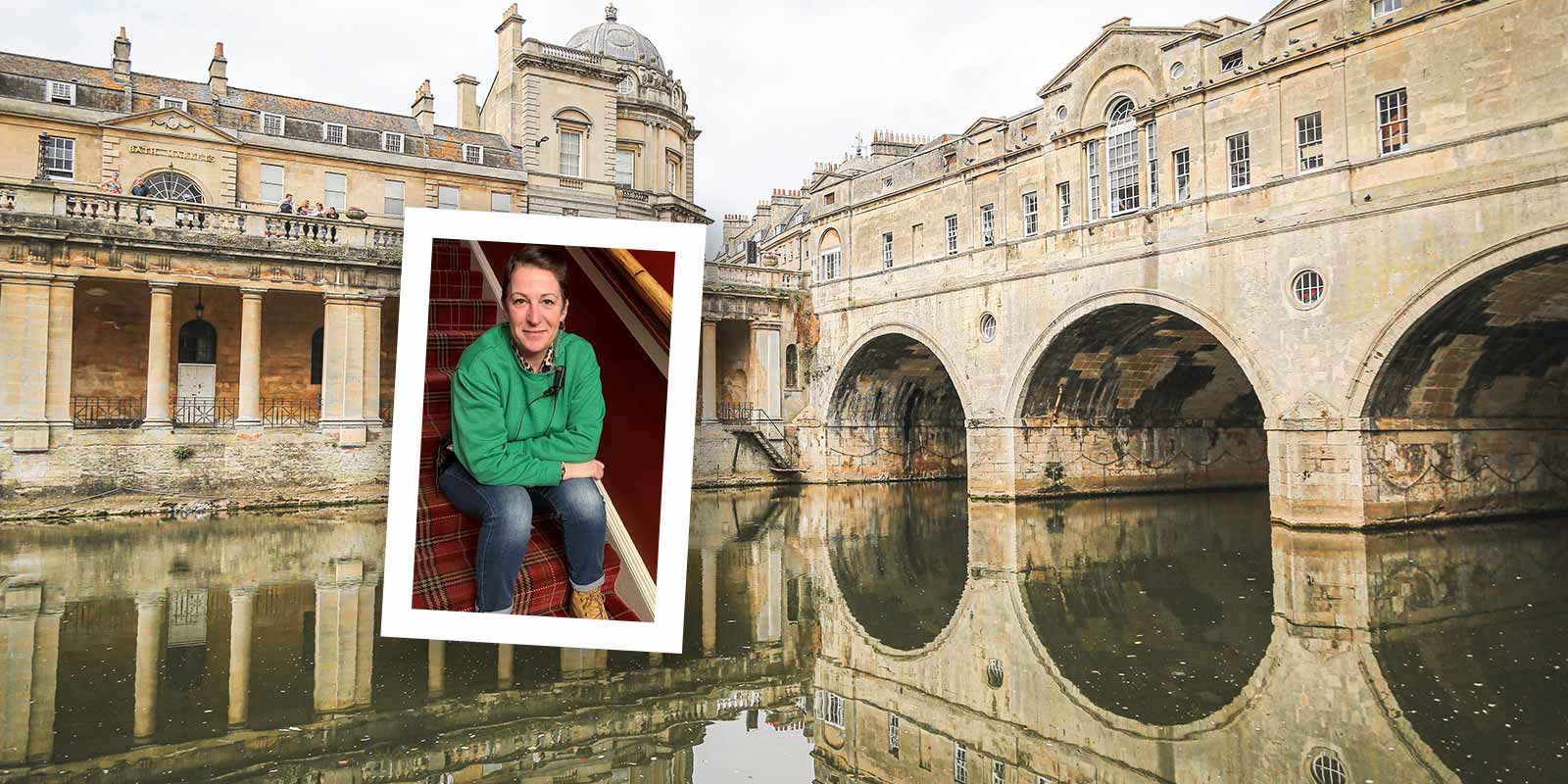

Let’s discuss your project, and how we can work together to secure the rebate for it.